Different types of bank loans in the USA include personal loans, mortgages, auto loans, and business loans. Each loan serves a distinct purpose for borrowers.

The landscape of bank loans in the United States is diverse, catering to a multitude of financial needs. Personal loans offer financial flexibility, allowing individuals to consolidate debt or finance large purchases. Mortgages enable homebuyers to purchase real estate, representing one of the most significant investments an individual will make.

Auto loans are specifically tailored to assist in the purchase of vehicles, providing options for both new and used cars. Business loans, on the other hand, support the financial demands of companies, ranging from startups to well-established enterprises, covering expenses like expansion, inventory, and operational costs. Understanding these loan types is essential for potential borrowers to make informed financial decisions that align with their personal or business objectives.

🔴Different Types of Bank Loans in USA🔴

Table of Contents

1. Mortgage Loans

Mortgage loans help buyers finance a house purchase. The home secures the loan, making it a big financial commitment. Different mortgage types suit various needs and situations.

1.1 Conventional Mortgage Loans

Conventional mortgages are not backed by the government. They often require higher credit scores and larger down payments.

- Fixed-rate loans: The interest rate stays the same.

- Adjustable-rate loans: The rate can change over time.

1.2 Fha Loans

FHA loans, backed by the Federal Housing Administration, are great for first-time homebuyers. They require lower minimum credit scores and smaller down payments than conventional loans.

| Pros | Cons |

|---|---|

| Lower down payments | Mandatory mortgage insurance |

1.3 Va Loans

VA loans serve veterans, service members, and select military spouses. The Department of Veterans Affairs backs these loans.

- No down payment is needed in most cases.

- No private mortgage insurance or mortgage insurance premiums.

1.4 Jumbo Loans

Jumbo loans finance more expensive homes. They exceed the loan limits set by the Federal Housing Finance Agency.

They require strong credit scores, significant down payments, and thorough documentation.

:max_bytes(150000):strip_icc()/bank-guarantee-4200955-1-6b0a6007286f4290a4c59366c1105945.jpg)

2. Auto Loans

Auto loans pave the road to owning your dream car. The journey to buy a car involves deciding between new and used, and whether to refinance an existing loan. Discover the various types of auto loans available in the USA.

2.1 New Car Loans

Lenders offer new car loans for the latest models. Benefits include lower interest rates and longer repayment periods. Check the requirements:

- Credit Score: Better scores secure lower rates.

- Down Payment: A higher initial payment reduces monthly bills.

- Debt-to-Income Ratio: This measures your ability to pay back.

Compare options from banks, credit unions, and online lenders. Choose one that suits your budget.

2.2 Used Car Loans

Used car loans help purchase pre-owned vehicles. Interest rates may be higher than on new car loans. Here’s what to consider:

| Factor | Description |

|---|---|

| Vehicle Age | Older cars might attract higher interest. |

| Mileage | Less mileage can mean better loan terms. |

| Condition | A car in good shape ensures easier loan approval. |

It’s essential to read the fine print and understand the loan’s full cost.

2.3 Refinance Car Loans

Refinance car loans offer a chance to lower payments on existing loans. They make sense when:

- Rates Drop: Interest rates have fallen since your vehicle purchase.

- Credit improves: Your credit score is now better.

- Income Changes: You’re making more or less money.

Shop around for the best refinance rates. A lower rate can mean huge savings over time.

3. Personal Loans

Personal loans can be an essential financial tool when you require funds without the need of specificity. Unlike a car or home loan, personal loans offer flexibility and can be used for a variety of purposes. Next, let’s explore the different types you might encounter.

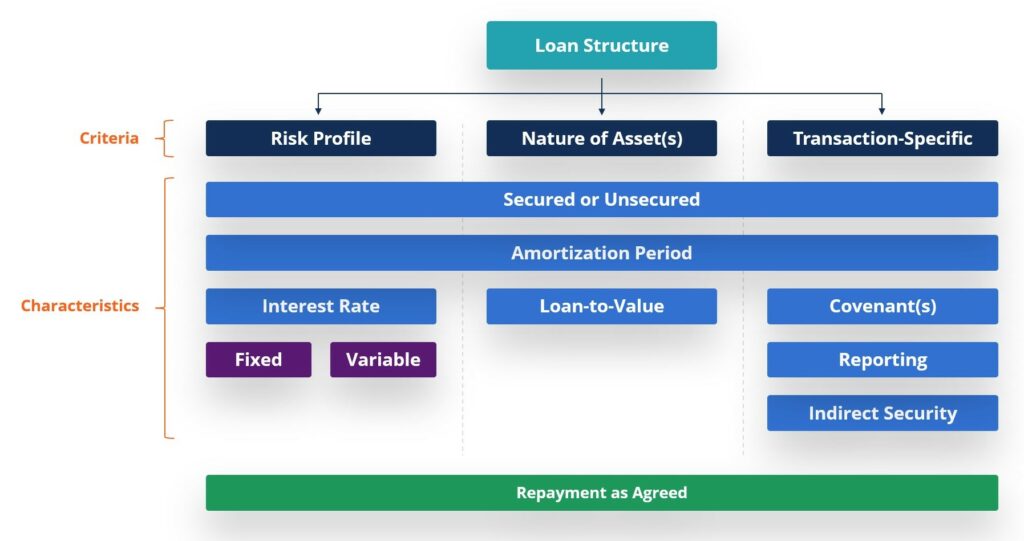

3.1 Secured Personal Loans

Secured personal loans are backed by collateral. This means that if you cannot pay the loan, the lender can take the asset. Examples of collateral include savings accounts, stocks, or physical assets like cars or real estate. Lower interest rates are a major advantage here, stemming from the reduced risk for lenders.

3.2 Unsecured Personal Loans

With no need for collateral, unsecured personal loans hinge on your creditworthiness. Although they may come with higher interest rates than their secured counterparts, they’re a popular choice due to the lack of collateral risk. Approval, however, might be tougher, and higher credit scores are often needed.

3.3 Debt Consolidation Loans

If you’re juggling multiple debts, debt consolidation loans might be your lifeline. These loans allow you to combine several debts into one, typically with a lower interest rate. This simplification means a single monthly payment and can often lead to faster debt elimination.

3.4 Student Loans

Student loans are tailored for education funding. They come in federal and private varieties, each with unique terms and benefits. Interest rates and repayment options vary, with federal loans usually offering more flexibility. They’re a critical resource for many pursuing higher education.

4. Business Loans

Entrepreneurs and business owners understand that securing the right financing is crucial for success. Business loans come in various types, each tailored to meet the specific needs of a company. Below is a breakdown of different business loan options available in the USA that help businesses grow and thrive.

4.1 Small Business Administration Loans

Small Business Administration (SBA) loans are backed by the federal government. This makes them less risky for lenders and more accessible for small businesses. SBA loans offer competitive terms, lower down payments, and flexible overhead requirements. They are ideal for:

- Start-up funding

- Expansion capital

- Disaster recovery

4.2 Commercial Real Estate Loans

For purchasing or renovating company premises, commercial real estate loans are perfect. These loans have higher amounts and longer repayment periods. They are typically used for:

- Office buildings

- Retail spaces

- Warehouses

4.3 Equipment Financing

Equipment financing supports the purchase of new or used machinery. It is suitable for businesses needing heavy equipment, technology, or vehicles. Repayment terms often align with the equipment’s lifespan. Key benefits include:

- Fixed interest rates

- Immediate use of equipment

- Tax benefits

4.4 Business Lines Of Credit

A business line of credit presents a flexible funding option. Companies can withdraw funds up to a certain limit and only pay interest on the amount used. This option is great for:

- Managing cash flow

- Unexpected expenses

- Bridging financing gaps

5. Credit Cards

Credit cards offer a revolving line of credit with various rewards and interest rates. As a flexible loan option, they cater to diverse purchasing needs and financial management strategies within the USA’s banking landscape.

Credit cards stand out among personal finance tools. These powerful cards offer flexibility and can affect your credit score. Whether you’re shopping, traveling, or managing your expenses, different types of credit cards match your lifestyle and financial needs. Let’s delve into the various options available in the USA.

5.1 Rewards Credit Cards

Rewards credit cards are like a pat on the back for spending. Each purchase earns points, cash back, or miles. Whether it’s for everyday use or specific categories like gas or groceries, these cards make spending more fruitful.

- Points can be used for travel, gifts, or shopping.

- Cash Back reduces your statement balance, giving you real money returns.

- Miles are perfect for frequent travelers, offering discounted or free flights.

5.2 Balance Transfer Credit Cards

Balance transfer credit cards offer a breathing space for high-interest debts. Transfer your existing balances to a new card with a lower rate. This move can save on interest, making it easier to pay down debts.

| Key Features | Benefits |

|---|---|

| Low introductory APR | Less interest accrues, making payments more impactful. |

| Balance transfer fees | Often a small percentage of the transfer amount. |

5.3 Low-interest Credit Cards

Low-interest credit cards are the go-to for budget-minded users. They offer lower ongoing APRs, which means carrying a balance is less burdensome. These cards help to save on interest over time. Ideal for those who occasionally carry a balance.

- Essential for emergency expenses.

- It is useful for large purchases made over time.

5.4 Secured Credit Cards

Secured credit cards require a cash deposit, serving as collateral. These cards are designed for building or repairing credit. Responsible use often leads to better credit opportunities and the return of your deposit.

- Deposit

- Acts as your credit limit and security.

- Upgrading

- A good payment history can unlock unsecured cards.

🔴Different Types of Bank Loans in USA🔴

Frequently Asked Questions For Different Types Of Bank Loans in the USA

How Many Types of Loans Are There in the USA?

There are various loan types in the USA, including personal loans, mortgages, student loans, auto loans, business loans, and payday loans.

What are the types of Loans In the Bank?

Banks offer various loan types, including personal loans, home mortgages, auto loans, student loans, and business loans. Each serves different financial needs for individuals or businesses.

What type of Loans are offered At Bank of America?

Bank of America offers various loan types, including home loans, auto loans, personal loans, and business loans. These options cater to different financial needs and goals of customers.

What are the four 4 classifications of Loans?

The four classifications of loans are personal loans, commercial loans, secured loans, and unsecured loans. Each type serves different financial needs and credit situations.

Conclusion

Navigating through the myriad of bank loans in the USA can initially seem daunting. From personal loans to mortgages and business financing, each option serves a unique purpose. Remember to review the terms, interest rates, and eligibility criteria before committing. Making an informed decision will set you on a path to financial success, ensuring the loan you choose aligns perfectly with your needs.

Insu Edu Tech Insurance, Education & Technology

Insu Edu Tech Insurance, Education & Technology